Executive Summary

The data center market stands at the intersection of digital transformation, artificial intelligence (AI) infrastructure demand, and critical power constraints. As enterprises shift workloads to the cloud and hyperscalers drive unprecedented capital deployment, the underlying infrastructure power, interconnection, and development timelines are under strain. This paper provides a market overview, outlines key investment trends in the sector, examines the rise of natural gas-powered onsite generation as well as ongoing permitting challenges and construction delays, noting the importance of local cooperative planning in enabling scale. It also highlights the emerging opportunity in smaller, modular data centers. For investors, operators, and developers, these shifts present compelling opportunities, across both core and secondary markets.

In summary, unprecedented global demand for data centers (as determined in units of power), far surpasses available inventory, which has led to massive construction of 1) new data center facilities and 2) power assets, both off-grid power assets and improvements/additions to the existing grid. Although media focus and the biggest data center capital projects revolve around big tech, smaller data centers — modular facilities and outposts closer to the consumption source(s) — are a growing market as well, which provides compelling investment and advisory opportunities.

Market Overview

Fueled by foundational demand drivers such as cloud computing, data generation, and storage, the global data center market is rapidly expanding, further accelerated by the burgeoning adoption of AI and machine learning (ML) technologies. The market is projected to grow at a compound annual growth rate (CAGR) of 10.3%, reaching $605 billion by 2031. This growth is driven not only by hyperscalers but also by mid-market enterprises, content delivery networks, and edge workloads.

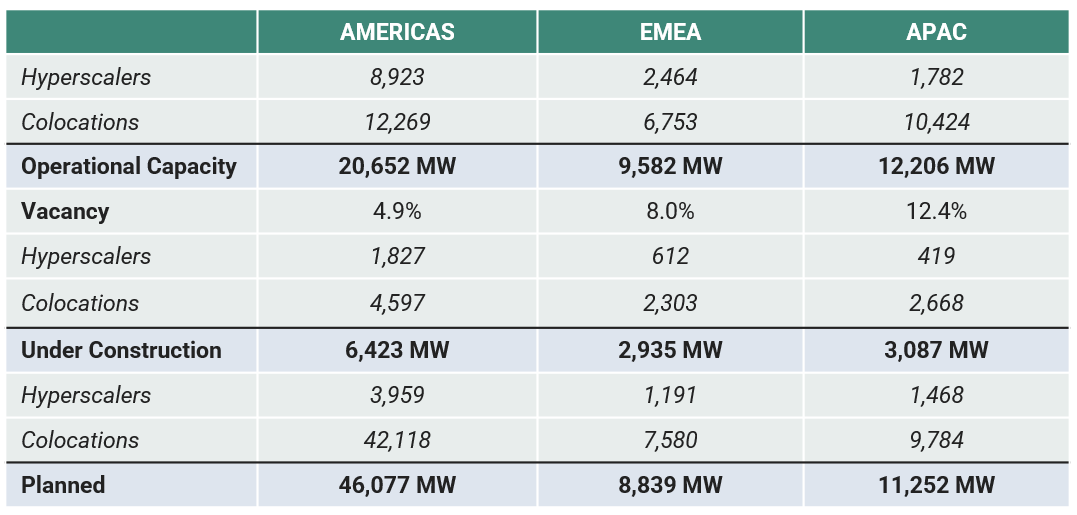

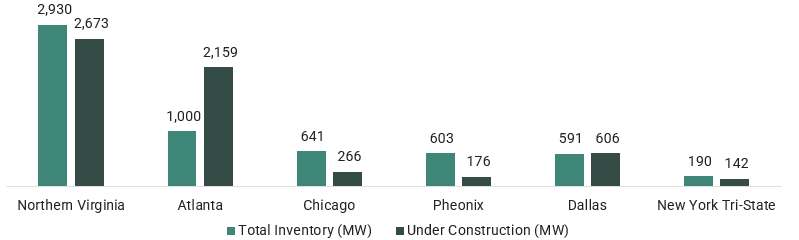

Total capacity is increasing across regions, with each expected to double or more with current development projects in progress.

Emerging Markets Advance Rapidly, Established Markets Stay the Course

Amid widespread power limitations, including restricted transmission capabilities and escalating land values, developers and self-builders are transforming into modern pioneers. The prime location for a data center is now anywhere that can supply the essential power.

Hyperscalers often spearhead this movement, being the first to enter emerging markets. Subsequently, colocation operators step in, leveraging the excess demand from hyperscalers to facilitate rapid expansion while catering to the data center needs of local enterprises, educational institutions, healthcare systems, financial bodies, and government agencies.

Despite the increasing focus on emerging markets, established markets continue to dominate data center activities, frequently showcasing considerably larger development pipelines.

Recent Investments Signal Unprecedented AI Infrastructure Build-Out

Hyperscaler capital spending, joint ventures, mergers and acquisitions (M&A) activity, and institutional commitments are fueling unprecedented data center growth. Technology leaders will invest over $350 billion in AI infrastructure during 2025 — spanning facilities, semiconductors, and power systems — while co-location operators leverage institutional capital for geographic expansion.

Private equity and infrastructure funds are responding with sponsor-backed rollups and greenfield utility partnerships. Strategic buyers, including digital real estate investment trusts (REITs) and telcos, are pursuing acquisitions while divesting non-core assets.

Recent major announcements in North America illustrate this momentum:

Power and Sustainability Partnerships:

• Google secured a $3 billion Hydro Framework Agreement with Brookfield Asset Management to deliver up to 3 gigawatts of carbon-free hydroelectric capacity, while also committing another $7 billion towards cloud, AI infrastructure, and workforce development programs in Iowa.

Regional Development Initiatives:

• Northern Data Group released plans for a 20-megawatt-capacity Pittsburgh-based facility for high-performance computing (HPC) and advanced AI model training.

• EdgeCore Digital Infrastructure is planning a 3.9 million-square-foot data center campus in Virginia with the capability of supporting 1.1 gigawatts of power.

•Novva Data Centers has announced Project Borealis, a new data center campus in Mesa, Arizona. The five new data centers will total 300 megawatts of capacity, with the first 96 megawatts phase scheduled to be energized by the end of 2026. PowerHouse Data Centers partnered with Pennsylvania Data Center Partners to construct three hyperscale campuses in Carlisle.

• CoreWeave committed $6 billion to develop AI infrastructure in Lancaster County.

• Vantage Data Centers entered Nevada with a planned 224-megawatt, 137-acre campus in Storey County featuring four multi-story facilities (the first two opening in 2026). The Dalles, near Portland, Oregon, approved Google's $600 million data center expansion.

AI Infrastructure Collaborations:

• Oracle and OpenAI expanded their partnership to develop an additional 4.5 gigawatts of Stargate data center capacity.

• Crusoe, Blue Owl Capital, and Primary Digital Infrastructure entered the second phase of a $15 billion joint venture to fund a 1.2 gigawatts data center in Abilene, Texas.

• DigitalBridge and La Caisse finalized their acquisition of global data center developer Yondr Group.

Power and Interconnection as Strategic Value Drivers

As data centers proliferate, certain ones are better positioned for optimal performance than others. One key strategic value driver is data center interconnection (“DCI” or “interconnectivity”). DCI refers to the process of linking multiple data centers together through high capacity, private connections such as dedicated private lines, dark fiber, Ethernet, and internet-based solutions. DCI enables rapid data exchange that bypasses the public internet, which minimizes latency, a crucial requirement for applications requiring real-time data processing, notably AI applications. Similarly, DCI allows data centers to share resources and bandwidth when demand is heightened, which, again, is crucial to servicing the heightened traffic (now and in the future) caused by AI.

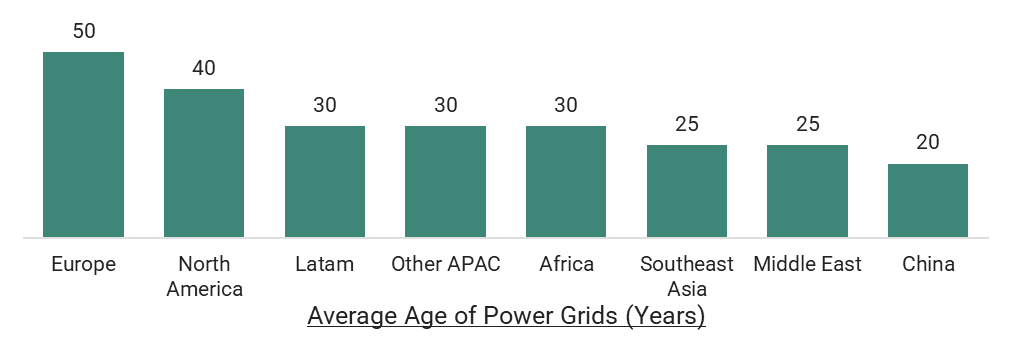

However, the ability to interconnect is increasingly constrained by limitations of existing transmission and power infrastructure. In Virginia — the world’s largest data center hub, specifically Northern Virginia — facilities already account for approximately 26% of state electricity demand.

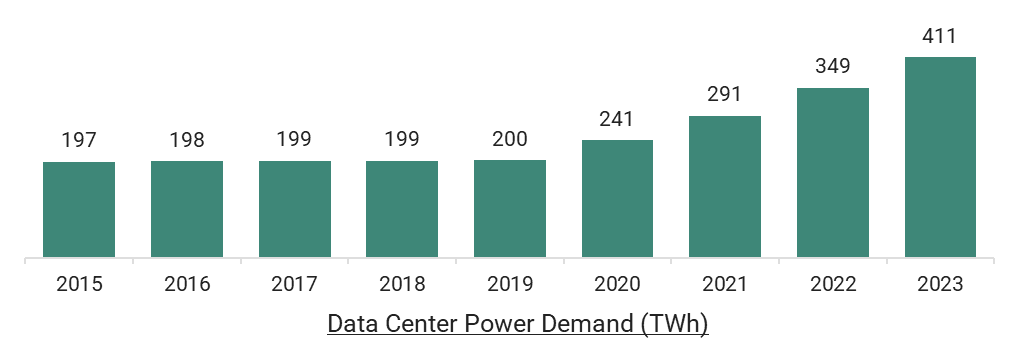

These issues are now top of mind for investors. A recent Business Insider report found that 36% of operators cite power availability as their biggest concern. McKinsey further projects that U.S. data center electricity demand will increase by 400 terawatt hours (TWh) by 2030 — the equivalent of 30% to 40% of all net new generation capacity.

From a capital markets perspective, these infrastructure challenges create strategic optionality. Developers that can secure interconnection, substations, or transmission rights ahead of demand are well-positioned to drive out-sized equity value or platform sale premiums.

Onsite Power Transformation: Shift to Natural Gas

As traditional grid-reliant development faces delays, operators are increasingly turning to onsite generation to ensure capacity, mitigate price volatility, and address environmental, social, and governance (ESG) pressures. The industry is shifting away from diesel backup — which has limited runtime and high emissions — toward natural gas-powered microgrids, fuel cells, and hybrid cogeneration.

Bloom Energy’s 2025 data center power report revealed that over 30% of operators now plan to use onsite generation as a primary or supplemental power source by 2030 — more than double from just a year earlier. Over 8.7 gigawatts of onsite capacity have already been announced or are under construction.

Natural gas, while transitional, offers a favorable emissions profile compared to diesel and enables higher uptime reliability. Additionally, it allows operators to move closer to full compute loads without waiting for utility upgrades. However, scaling these systems requires addressing critical enablers: proximity to high-capacity pipelines, firm gas supply contracts that hedge pricing volatility, and air permitting that can add significant time to project delivery. Infrastructure investors are increasingly underwriting these systems as part of broader digital infrastructure platforms.

Pairing a natural gas generation system with grid connectivity unlocks its full energization potential. A natural gas “microgrid” is a localized power system that can function independent of the energy grid but is also connected to the energy grid and can therefore pull energy from the grid when needed as well as deliver energy to the grid. When paired with grid connectivity, a natural gas microgrid can both draw from and contribute to the grid, offering resilience and operational independence during outages or extreme weather. “Grid integration remains a scaling challenge as many utilities are reluctant to allow large private microgrids to export power back to the grid, which can limit financial upside. Local cooperatives and municipalities have an opportunity to embrace microgrids through master planning and proactive infrastructure policy, creating a pathway for data centers to enter their regions while aligning with community resilience goals,” said Mara Ervin, director of Data Centers at Stonebridge.

Development Constraints and Strategic Responses

While data center demand remains strong, permitting has become a rate-limiting factor in data center growth. Planning approvals, environmental reviews, and community opposition often push project timelines to 24–36 months or more, differing drastically by state, utility cooperation and brownfield versus greenfield. Interconnection queues with regional utilities are also backlogged, with many developers waiting years for substation or line upgrades.

On July 23, 2025, the White House issued an executive order titled, “Accelerating Federal Permitting of Data Center Infrastructure.” This order reflects a broader goal of the current administration to reduce delays for data center projects supporting AI workloads by streamlining federal environmental review and other permitting processes. The order also proposes streamlined permitting processes for data centers that are being sited on “brownfields” and federal land, i.e. siting data centers on particular types of land could avoid the need for state-level/local permitting processes. That said, barring the federal land scenario just mentioned, state-level/local permitting processes will still be required.

This regulatory gridlock, combined with interconnection bottlenecks, and, in certain cases, community opposition to data center construction, creates opportunities for early-stage capital providers and strategic M&A. Investors who can pre-capitalize sites, secure entitlements, or de-risk permitting through partnerships with municipalities are poised to generate premium valuations — especially from hyperscalers who require speed to market.

Advisory opportunities exist to help clients navigate these bottlenecks through: site diligence and early-stage capital formation; and structured finance solutions for long lead-time projects.

The chart below depicts total data center megawatt capacity under construction relative to existing inventory in particular metropolitan areas as of H2 2024. The ratio of existing inventory / inventory under construction is close to 1x or less than 1x in many cases, which quantitatively depicts the rapid growth in data center construction underlying process bottlenecks.

Rise of Secondary and Modular Assets

While hyperscalers continue to dominate headlines, a parallel trend is emerging — investor and operator interest in smaller, faster-to-deploy facilities in secondary markets or near-edge compute zones. These assets offer faster time to revenue, lower capex intensity, and greater location flexibility — especially valuable in markets where land or power is constrained.

The edge data center market alone is forecast to grow from $7.2 billion in 2021 to $19.1 billion by 2026, driven by the Internet of Things (IoT), AI inferencing, and latency-sensitive enterprise use cases. Modular solutions, containerized designs, and brownfield conversions are gaining traction among private equity buyers seeking quicker ROI and differentiated go-to-market strategies.

As AI workloads diversify, the definition of “valuable” infrastructure is shifting. Secondary assets are no longer second-tier — they are becoming strategic complements to core campuses. This opens up acquisition targets and capital-raising pathways for mid-market platforms that might otherwise be overlooked.

Conclusion: Positioning for Strategic Growth

The next 24 months will define the winners and losers in digital infrastructure. Between AI-driven demand, power and permitting constraints, and evolving asset profiles, investors and operators alike must reposition their strategies. For investment bankers and advisors, this landscape presents a broad array of opportunities:

M&A advisory: hyperscale carve-outs, platform roll-ups, divestitures of stranded assets.

Capital raising: structured equity, project finance for power generation, pre-development capital.

Strategic consulting: site planning, interconnection strategy, energy procurement.

As the data center evolves from a “box with servers” into a vertically integrated, energy-interconnected, globally strategic asset class, those who understand both the digital and physical levers of value creation will lead the market.

For more information, please contact: Jeff Goodman or Abhishek Pathania.

© Copyright 2025. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.

unknownx500

unknownx500