Goldilocks Backdrop

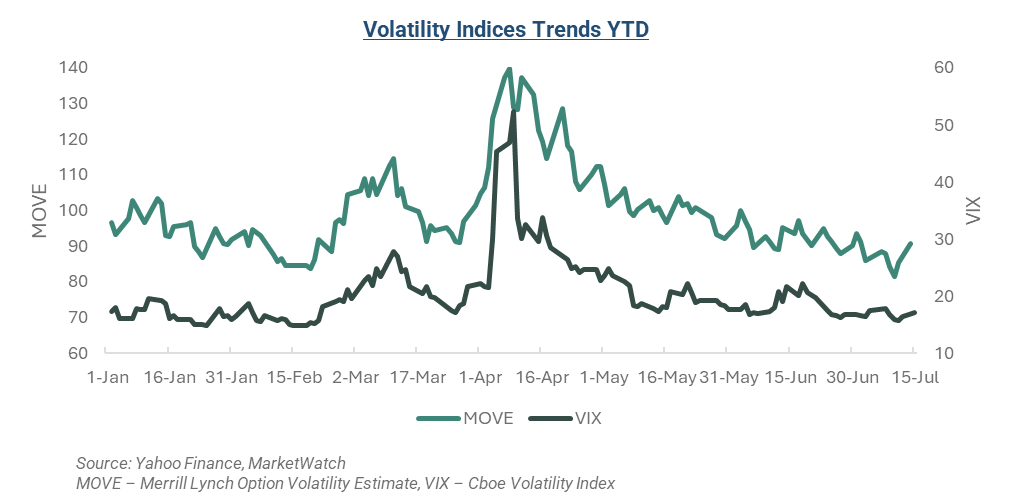

After sharp spikes following Donald Trump’s ‘Liberation Day’ tariff announcement on April 2nd, both the Merrill Lynch Option Volatility Estimate (MOVE) and the CBOE Volatility index (VIX) have normalized in Q2 and have declined YTD (~6% and ~1%, respectively). The June core inflation reading of 2.9% YoY could be indicative of slightly elevated inflation going forward partly as a result of new tariff policy, but unemployment is low, consumer spending is stable, the stock market is on an uptrend and rate cuts might be on the horizon. These conditions are consistent with a goldilocks environment, although prominent figures have warned against complacency, citing concerns such as inflation, the impact of tariffs, worsening geopolitical conditions, fiscal deficits and the rapid growth of private credit.

Rate Cuts and This Cycle’s Terminal Rate

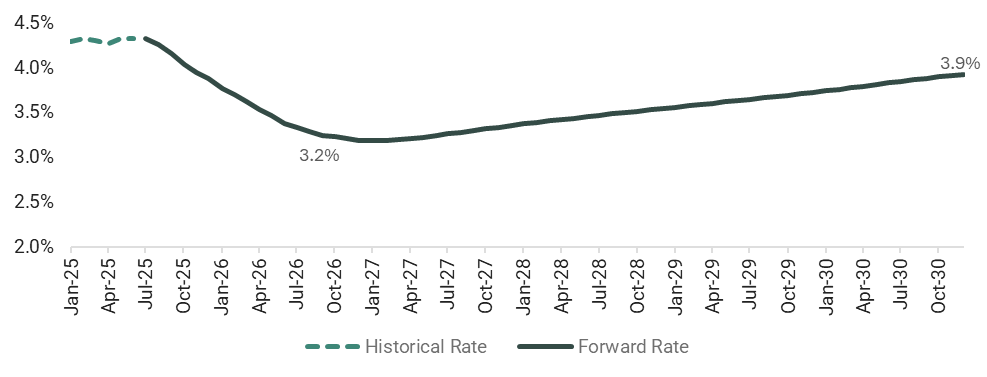

The Fed held rates steady at the July FOMC meeting, but unlike the last several meetings, the choice was not unanimous. As of 7/31/25, the Fed Funds futures market is pricing in a 46% probability of a September rate cut (down from 65% pre-July FOMC meeting) and is pricing in only one 25 basis point cut by year-end. That said, the futures market is signaling a year-end 2026 Fed Funds rate in the 300 – 325 bps range. Looking at the larger picture, rate cuts in the next 12 to 24 months could provide a short-term boost to the credit markets, but the more relevant long-term question is, what will be this cycle’s terminal rate? Goldman Sachs is forecasting a terminal rate in the 300 – 325 bps range which, relative to the 2008 to 2022 period, would be a ‘higher for longer’ interest rate holding pattern which could stress test the less regulated waters of private credit.

3-Month SOFR Curve

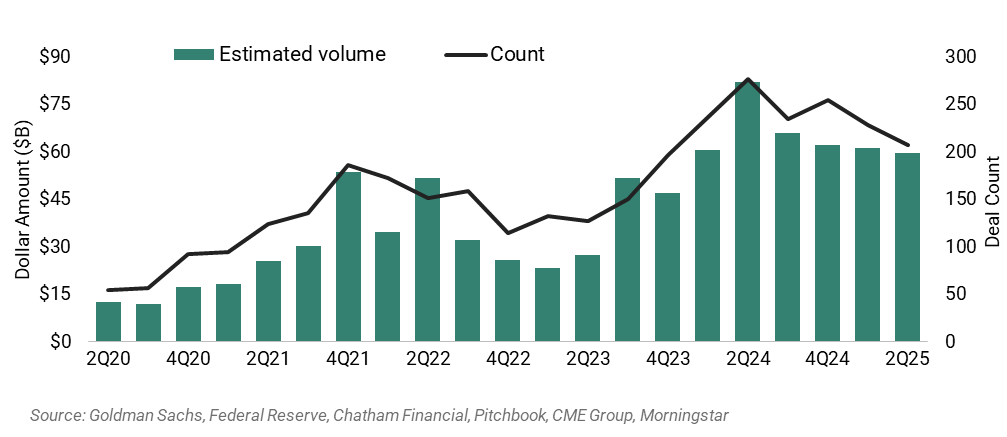

Private Credit Direct Lending Volume Decreased Slightly in Q2

Types of Private Credit

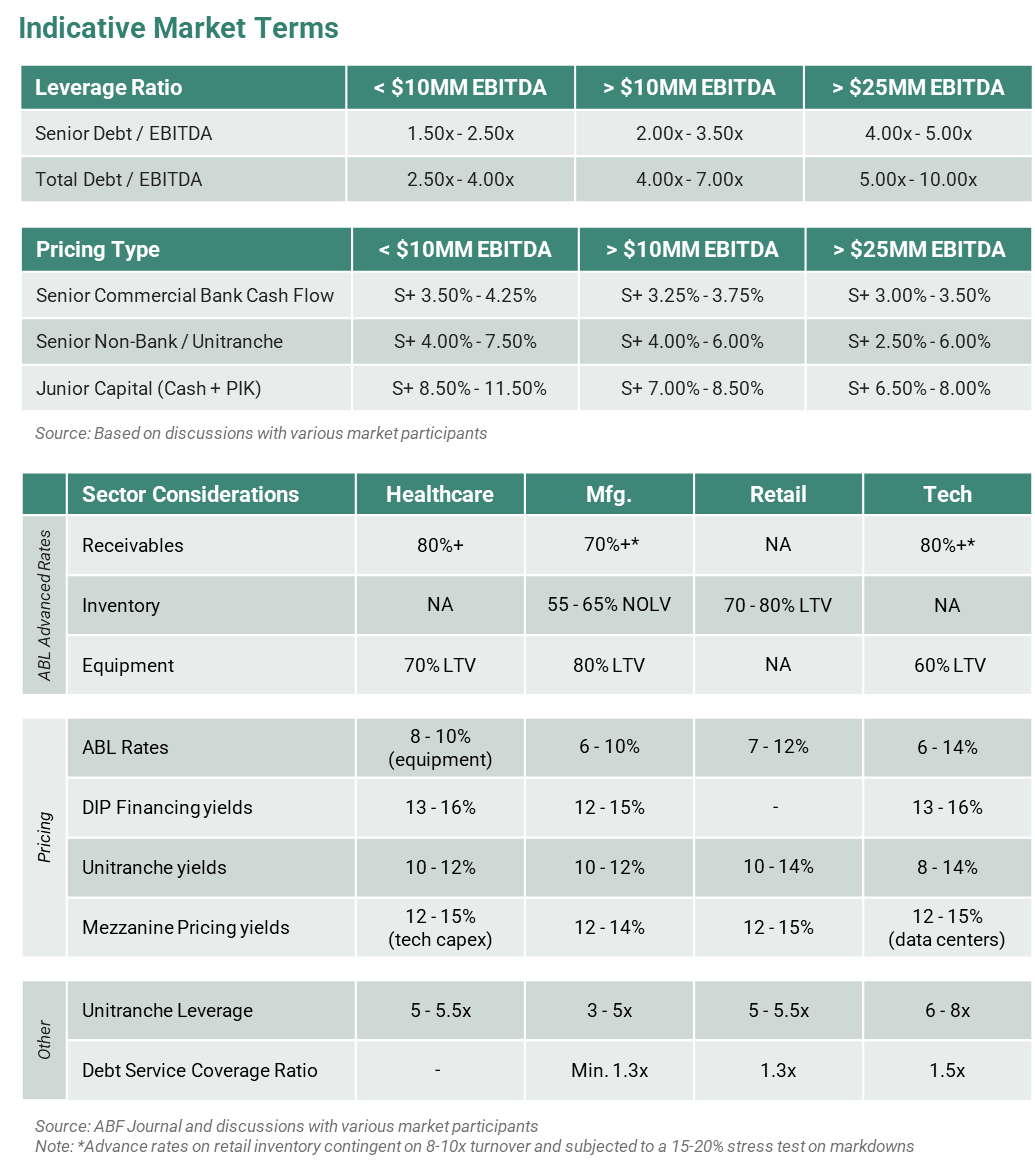

Private credit plays an increasingly pivotal role in filling the lending gap left by traditional banks after the financial crisis in 2008. Private Credit offers flexible and bespoke financing options, both asset-based and cash flow driven, to middle market borrowers and private equity firms:

- Asset-Based Lines: Higher advance rates on receivables, inventory (even international) & equipment

- Bridge Loans: Quick cash to smooth timing hiccups

- Senior Cash Flow: First lien cash flow facilities at or near traditional bank financing rates

- Mezzanine Financing: Subordinated debt with equity upside, keeping ownership intact

- Unitranche: Senior and junior tiers of debt blended into a single offering

- Non-Traditional Collateral: Tapping IP or royalties for offbeat deals

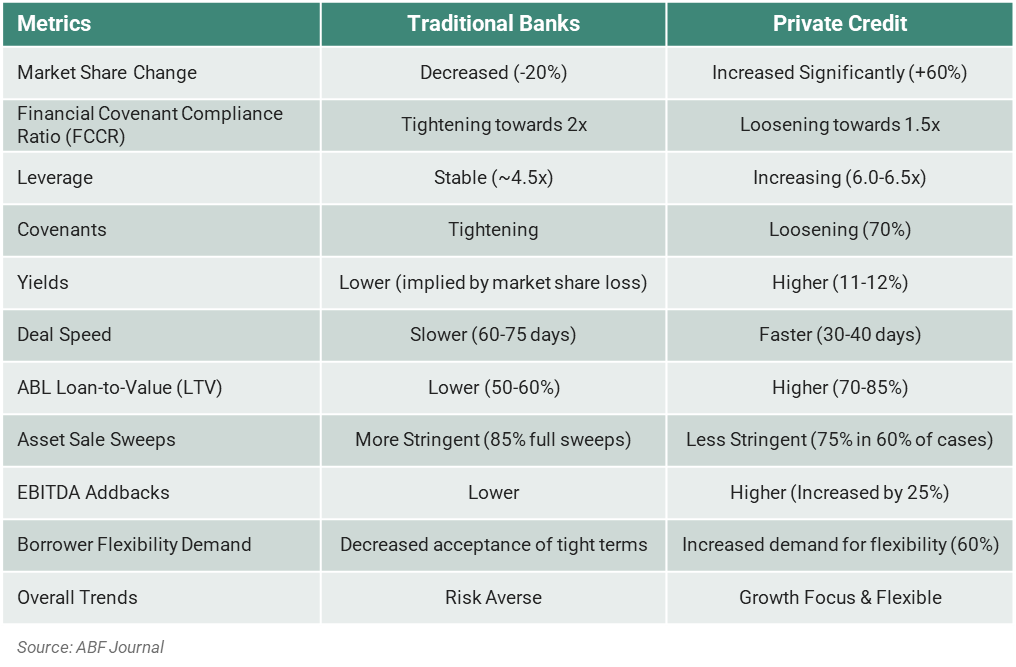

Benefits of Private Credit vs. Traditional Banks

Private credit lenders bring speed (30–60-day closings), flexibility (such as PIK toggles), and value-added expertise at relatively competitive pricing.

Benefits with specialty credit

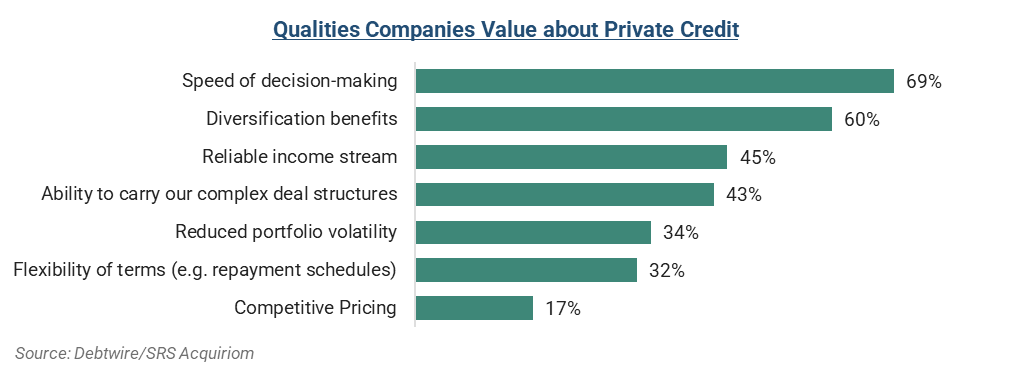

In a calmer, but still choppy, market, Debtwire / SRS Acquiriom’s recent survey found that speed of decision-making (69%) is the top quality that companies value about private credit.

But sourcing the right lender to produce the best term sheet can be challenging and time consuming

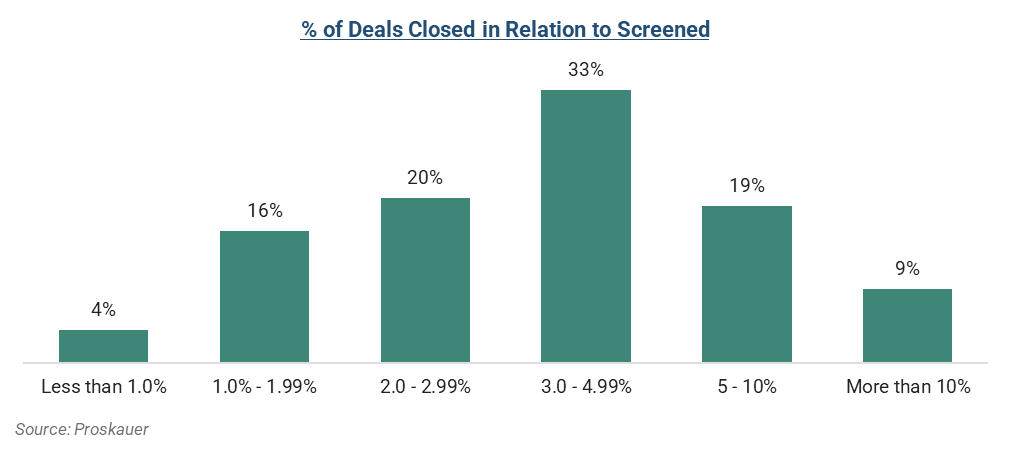

A recent Proskauer survey of 152 private lenders revealed that less than half (27%) of private lenders close more than five out of every one hundred deals they review. For middle market companies and their sponsors focused on day-to-day operations, the time involved in sourcing the right lender with the optimal terms can be a substantial distraction.

How Ankura Capital Advisors can help

The professionals at Ankura Capital Advisors know the market and know the lenders. We work closely with both sponsor backed, and non-sponsor backed companies, assisting them in sourcing the most competitive financing terms from the lenders best suited to help companies recapitalize and/or grow their business.

TRANSACTION TYPES | STRUCTURES |

Sell and Buy-Side M&A | Secured Loans: |

§ 363 and Article 9 sales | Asset-Backed and Cash Flow Loans |

Refinancings | 1st and 2nd Lien and Unitranche Loans |

Buyouts, Recapitalizations, and Carve-outs | Fund Level (NAV) Loans |

Growth Capital, “Rescue” Capital, DIP Financing | Other Structures: Mezzanine, Pref Equity |

For more information, please reach out to Jeffrey Goodman.

© Copyright 2025. The views expressed herein are those of the author(s) and not necessarily the views of Ankura Consulting Group, LLC., its management, its subsidiaries, its affiliates, or its other professionals. Ankura is not a law firm and cannot provide legal advice.

unknownx500

unknownx500